Allocating your marketing budget for the end-of-year holidays is tricky business. Since this is a peak period for shopping, choosing to invest in less effective advertising methods can significantly impact your revenue.

How can you know which advertising methods will be most effective? By looking at consumer preferences.

In early September, we surveyed over 1,100 U.S. consumers to discover what 2022 holiday shopping will look like. Among the survey’s questions, we asked which are the biggest sources of inspiration for holiday shopping, revealing exactly which types of promotion are likely to be the most effective.

To get the full details of our case study, download the PDF:

Without further ado, here are our 10 shopping predictions for the end-of-the-year holidays!

- Holidays most likely to generate high revenue

- Consumers will start shopping early this year

- There will be a mix of online sales and in-store purchases

- Inflation might not have a huge impact on holiday spending

- Saving is mainly a matter of looking for sales and deals

- Most gift budgets will remain generous

- Holiday shopping inspiration comes from multiple sources

- Thanksgiving activities and shopping plans

- Christmas activities and shopping plans

- New Year’s Eve plans

1. Holidays Most Likely to Generate High Revenue

It’s no secret that the Winter holidays are the most popular and top-grossing holidays of the year.

According to a survey conducted by Statista in 2021, Thanksgiving and Christmas are frontrunners in people’s preferences, from a selection including both national and religious events throughout the year.

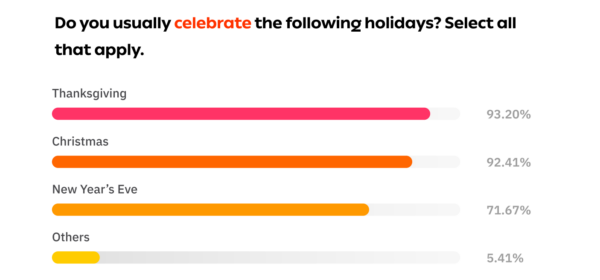

This is mirrored by our own survey results, as when we asked participants to choose the end-of-the-year holidays they usually celebrate, Thanksgiving came in first with 93.20% of votes, and Christmas claimed second place with 92.41% of responses.

They were followed by New Year’s Eve, which gathered 71.67% picks, while a very small percentage of 5.41% of individuals reported celebrating other holidays.

2. Consumers Will Start Shopping Early This Year

Americans know how overwhelming last-minute holiday shopping can get. They do not want to have to navigate jam-packed malls, stress due to low or unavailable online stocks, or deal with shipping delays, so they prefer to start buying what’s necessary for their celebrations ahead of time. According to Salesforce, 37% more shoppers in the U.S. will start buying gifts earlier.

Our survey reveals the majority want to kick off shopping a month before the holidays (29.38%), and a considerable share intends to begin as many as two months ahead (19.97%). Of course, some plan to do their shopping two weeks (11.42%) ahead or even closer to events, but the trend is to get it done sooner than that.

Considering this, retailers should solve any inventory issues they might have and make sure brick-and-mortar store shelves are stocked and e-commerce stores are fully supplied.

Are low prices and good deals a priority for consumers?

In our survey, we also asked the participants when they plan to start checking prices and hunting for deals, and it turns out the timing overlaps with when they intend to begin shopping—26.59% selected a month ahead, and 21.80% went with two months before the holidays.

This shows U.S. consumers are ready to buy what’s needed for the end-of-year holidays starting early fall. As a result, companies need to check their marketing calendars and adjust advertising campaign dates to keep up with early shoppers.

Creating and launching ads at the right time can really make a difference in revenue at the end of retail’s busiest season.

3. There Will Be a Mix of Online Sales and In-Store Purchases

In 2020, U.S. e-commerce sales saw a notable boom due to the pandemic. The U.S. Department of Commerce reported the growth continued in 2021 with a 14.2% year-over-year increase and carries on in 2022, albeit at a slower rate.

In the second quarter of 2022, there was a 6.8% increase in online sales compared to the same period in 2021. However, it is lower than the one registered in Q2 2021, when there was an increase of 9.1% from Q2 2020.

When asked how they plan to do their holiday shopping this year, most of our respondents (42.89%) answered with “equally in-store and online”. However, out of the remaining individuals, 41.24% voted for online shopping, and only 15.87% chose in-store shopping, showing a preference for e-commerce.

Still, retailers shouldn’t ignore that interest in physical store experiences has made a comeback after the pandemic. The best strategy to approach this shift in consumer behavior is to merge the online and physical shopping experiences (e.g. buy online, pick up in-store options) while relying on creative e-commerce ads to drive sales this holiday season.

Based on which criteria do consumers pick stores?

Whether they add to cart from the comfort of their home or go to a physical location, there are specific motives that make consumers choose one shop over another. Businesses need to understand these to attract more customers, so we asked our survey participants to reveal three of the most important things they consider when picking a place to shop for the holidays.

Getting free shipping is at the top of consumers’ priorities, as 67.22% had this as one of their three picks. Almost equally as important are deals and promotions, with 65.82% votes.

In a period of significant price hikes, it’s no wonder consumers want the cost of products to feel justified, with 58.33% of them picking “value for price”. They are also inclined to choose retailers that have multiple products they desire in stock (40.19%).

4. Inflation Might Not Have a Huge Impact on Holiday Spending

In 2021, the NRF reported holiday spending had been gradually increasing since 2009. Not even the pandemic managed to break the ascending trend, so will inflation be what does?

In June 2022, the inflation rate in the U.S. reached a concerning rate of 9.1% but dropped by 0.6% the following month. Subsequently, the University of Michigan’s consumer sentiment index went up in August, suggesting people are starting to feel better about shopping.

When our respondents were asked how worried they were about inflation impacting their holiday shopping on a scale of 1 to 5 (1 being very worried and 5 being not worried at all), almost half of them (49.17%) replied with either “worried” or “very worried”.

This suggests there is indeed a level of concern about the matter of inflation, but it might not be enough to translate into a decrease in end-of-year holiday spending, especially since consumers plan to start shopping early and spread their expenses across a few months.

How will this year’s holiday spending compare to previous years?

Data from ICSC’s 2021 post-holiday survey reveals consumers spent an average of $1,011 last holiday season, marking a record-breaking success for holiday shopping.

We were curious about how much our survey’s respondents estimated they would spend this year in the context of inflation and growing prices. With responses to the previous question in mind, we can’t say we were surprised by their expectations.

A little over a third of them (36.62%) estimate they will be spending about the same amount of money as last year. A slightly smaller share (31.56%) plans to top 2021’s holiday expenses, while a similar percentage of responders (31.82%) intend to spend less.

To get the full details of our case study, download the PDF:

5. Saving Is Mainly a Matter of Looking for Sales and Deals

With inflation running rampant, smart spending seems like the sensible thing to do. Considering this, we asked our survey participants to pick three measures they will take to ensure this year’s holiday shopping doesn’t take too big a bite from their finances.

The top two choices were buying items on sale and searching for the best deals online, with 71.58% and 54.75%, respectively. This indicates many U.S. consumers will do at least part of their holiday shopping on Black Friday and Cyber Monday, the main sales events close to the end-of-year holidays.

A considerable share (33.65%) will rely on coupons to get discounts, while only for 38% of the respondents, Santa’s bag will not overflow this year because they plan to reduce costs by purchasing fewer gifts.

6. Most Gift Budgets Will Remain Generous

Many consider gift-giving an essential holiday tradition, and despite financial uncertainty, they might not be willing to sacrifice gift budgets.

According to The National Retail Federation, consumers spent an average of $648 on gifts in 2021, roughly the same as in the previous four years.

When asked how much they intend to spend on gifts this holiday season, 45.77% of our survey participants responded with more than $200, meaning there could be a chance for this year’s gift spending to be in the same ballpark as that of last year.

The following most popular choices were the $150-$200 and $100-$200 budget ranges, with a considerably lower number of votes, 15.26%, and 14.04%, respectively. Nonetheless, the top three picks were the highest amounts on the list, suggesting consumers are inclined to spend more on gifts rather than less.

7. Holiday Shopping Inspiration Comes from Multiple Sources

In our survey, we found out that word of mouth is the most popular source of inspiration for holiday shopping (52.05%), so it is up to businesses to offer quality products or services if they want customers to spread the word about them.

U.S. consumers also get ideas of what to buy from relevant online ads (40.63%), meaning retailers have big chances to drive purchases this holiday season by investing in digital advertising campaigns.

Another big force that drives interest in different items is social media (35.14%). Besides running ads on various platforms, companies should also post content regularly and get influencers or creators to promote their products.

TV ads play a role in how holiday to-buy lists end up looking, too (28.16%), so companies shouldn’t ignore traditional advertising because it can attract a fair share of customers.

8. Thanksgiving Activities and Shopping Plans

Thanksgiving is the time to be grateful and get together with loved ones around the dinner table, and this is precisely what consumers plan to do this year, as per our survey’s results.

With 77.17% of the votes, gathering with family and friends is the most popular holiday plan, followed closely by cooking and baking (56.78%), as the two often go hand in hand.

Some will contribute to the festive atmosphere by decorating the house (21.14%), while others will travel (18.33%), presumably to visit relatives or join other Thanksgiving celebrations.

What will consumers buy this Thanksgiving?

Celebration aside, Thanksgiving weekend is one of the best-selling in the U.S, mainly due to Black Friday and Cyber Monday. According to eMarketer, in 2021, sales for the three events amounted to $25.1 billion. They also reported the top-performing product categories for the entire holiday season of 2021 were apparel and accessories, computer and consumer electronics, auto and parts, and toys and hobbies.

We also asked consumers what they plan to purchase this year during Thanksgiving (Black Friday and Cyber Monday included), and apparently, things won’t be much different from last year. Apparel, footwear & accessories came in first (40.88%), followed by toys, games & hobby (35.08%) and computer/electronics (33.68%).

9. Christmas Activities and Shopping Plans

The main activities for the jolliest holiday of the year are similar to those outlined for Thanksgiving.

Spending time with family and friends on Christmas is the number one top priority for U.S. consumers, given that 73.30% of the surveyed individuals said it is one of their top three picks. Gift-giving is right behind it, with 56.04% of the votes, followed by cooking and baking (45.85%), which makes perfect sense because Christmas dinner is just as important as the Thanksgiving one.

Besides these, decorating reunited 27.83% of the responses, pointing out some people look forward to putting up festive wreaths and ornaments or going out and buying the perfect Christmas tree.

What will consumers buy this Christmas?

Most of these festive activities (especially gift-giving) require at least a minimum amount of shopping, so we asked respondents to select their top three must-have types of products for this Christmas.

Judging by their responses, a lot of this year’s presents will be clothing items, footwear, or accessories (45.19%), mixed with toys, games, and hobby supplies (43.30%). There’s also a high interest in computers and electronics (33.68%), and it’s worth mentioning gift cards were a popular choice for our open-answer option.

The frontrunner product categories match those from the question about Thanksgiving purchases. This falls in line with the idea that people start their holiday shopping early and buy at least some of their Christmas gifts during the Fall.

10. New Year Plans

The last night of the year will find many U.S. consumers getting together with relatives and friends, as this is the most popular plan according to our survey responses (59.12%). Some will cook and bake (33.21%) for their respective guests, while a smaller share of people will be ordering in (21.29%). There are also those who will say goodbye to 2022 by attending a party (28.83%) or going out (19.71%).

These responses suggest we can expect to see sales in food & beverages and an increased interest in catering and food delivery services around New Year’s Eve.

Want to get the full scoop and analysis of our findings? Then download the PDF format:

Methodology

This survey ran on Survey Monkey between September 5 and September 6, 2022. It had a confidence level of 95% and a margin of error of 3%. Out of 1,174 respondents, only 1,147 qualified based on their answers to the first question.

Regarding distribution, we used Survey Monkey Audience, targeting U.S. consumer shoppers over the age of 18. This audience has the attribute of “Primary Decision Maker in Household.”

In terms of household income, we had respondents with an average annual income anywhere between $0 and $200,000+, most of them as follows:

$10,000 – $24,999 (10%)

$25,000 – $49,999 (19%)

$50,000 – $74,999 (20%)

$75,000 – $99,999 (12%)

$100,000 – $124,999 (9%)